Table of Content

Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

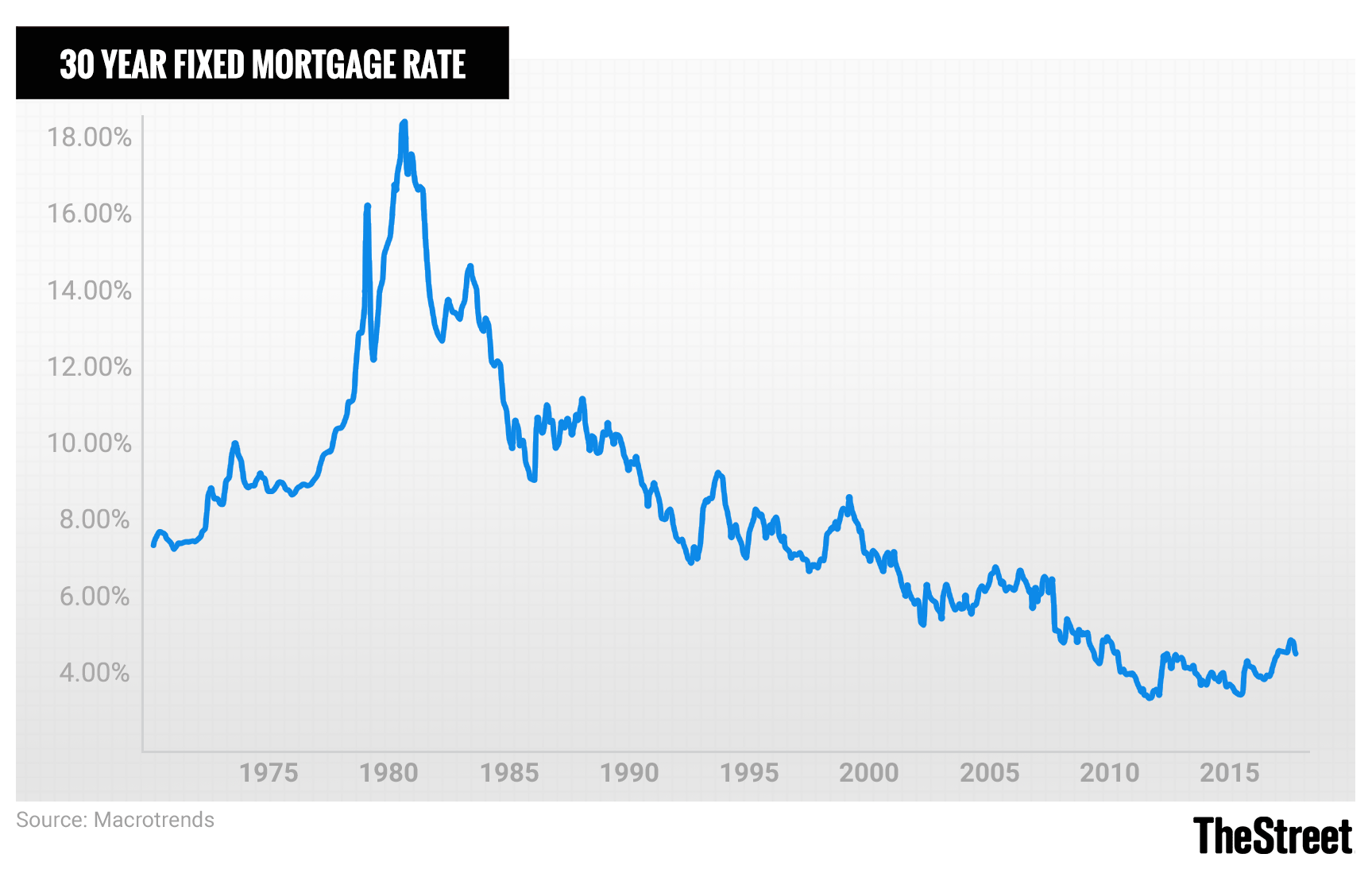

While borrowers are relieved to see the pace of tightening slow down , a number of economists believe there is still a long way to go before the RBA can confidently say inflation is under wraps. But rates are expected to rise further, so 3% may soon be considered a good rate again soon. If settlement day is fast approaching and you haven't got a home loan approved, the best home loan is the one that a lender will approve quickly. They probably haven't saved a 20% deposit, so they'll need a loan with a maximum insured LVR of 90% or 95%. Has the toughest servicing assessment out of the big four for foreign income applications. One of the tougher servicing assessments for foreign income applications.

Common Mortgage Rate Questions

Your interest might be calculated daily, monthly, quarterly or annually. Daily interest is best because it’s calculated as your principal loan reduces, and so you’ll pay less interest all up. Annual interest, on the other hand, is calculated each day, but based on a yearly principal, which means it takes a whole year before you’ll pay less interest. If you’re on anything other than daily interest, try to time your monthly repayments to be before your interest is calculated, so you’ll be paying interest on the lowest principal possible.

You can speak to a mortgage broker to widen the scope of your options. A mortgage broker can help determine which lenders and loan products suit your current financial needs. Refinancing to a variable rate might be tricky — if you are currently in the middle of a fixed term and you decided to switch to a variable rate, you might end up paying the break costs. When your home loan is left unchecked for quite some time, it can pale in comparison to the newer loan products being offered to new applicants. This makes it ideal for you to review your loans regularly and see if refinancing is necessary to ensure that your mortgage is still as competitive as the ones in the current market.

Do you want to make principal & interest or interest-only repayments?

She cannot purchase an investment property with an owner-occupier loan. When looking at loans for investors, we analyse loans for investment purposes only (no owner-occupiers) that require minimum deposits of 20% or lower. For investors who are refinancing only, this loan has a fast online application and low interest rates as well as annual discounts for the life of the loan.

The downside, however, is that if rates decrease while you’re on fixed term interest, you won’t reap any of the benefits. When your fixed term ends, you have the option to either enter into a new fixed rate or switch to variable rates. Minimum amount of $500,000 and LVR less than or equal to 80%. To work out if a package loan is right for you, be sure to factor in the cost of the package fee.

Mortgage Comparison

ANZ is the second largest bank by assets and the third largest by marketing capitalisation in Australia. One of the toughest servicing assessments for foreign income applications. Based on the purchase/refinance of the applicant at settlement. CBA, ANZ, NAB, Wesptac products may not be available to foreign nationals. Finder's First Home Buyers Report explores the attitudes and behaviours of new homeowners in a rapidly shifting housing market.

Buyers develop the other motives on account of a service that they want to receive from the property or its setting. For instance, a buyer seeking a property on which to retire on should consider the proximity to essential services like medical care. People looking for a home to settle in or a property with easy access to their workplaces should also consider the availability of the essential needs. Calculate your repayments and get tips on how to pay off your loan sooner. Whether you’re looking to occupy or invest, we can help you find home loan rates that work for your situation.

Financial services guide

Learn how you can increase your borrowing power and how the banks assess your income. It’s important to match your mortgage to your financial goals. Here are some goals you may have in mind and the mortgage loan options that could help you reach them. The Reserve Bank of Australia has decided to leave the cash rate unchanged at 0.10 per cent. Westpac is the second largest bank in terms of household lending in Australia sitting at $405bn in outstanding loans, with $177bn of that in Investment lending. When it comes to your Australian mortgage options, the Wealth/MAV Package is typically recommended for loans over $250,000.

Some “Enquire” buttons will take you to a third-party mortgage broker. If you decide to find out more or apply for a home loan, your details will be sent to the broker and you’ll deal directly with the broker, not with Canstar. Any advice on this page is general and has not taken into account your objectives, financial situation or needs. Consider whether this general financial advice is right for your personal circumstances. Manage your loan online Redraw, change your repayments or loan type to better meet your needs and more.

The older and established generation is unsympathetic to the economic fluctuations and, therefore, makes little effort to evolve as changes occur in the market. With such a rigid supply base, in-depth exploration of the real estate industry is necessary before investing in any property. Therefore, a prospective buyer should consider mortgages rates offered in the industry and their ability to keep up with the payments.

The National Credit Code requires that lenders show comparison rates - which factor in interest, fees and charges - to give you a clearer idea of the true cost of a loan. So when you compare home loan interest rates on Mozo, you’ll see an interest rate plus a comparison rate for each product. However, it’s a popular type of home loan in Australia, as variable rates often sit lower than fixed rates.

Following the RBA cash rate decision, we’ve announced that our home loan variable interest rates will increase by 0.25% p.a. The banks will be looking at acceptable debt-to-income ratios for any loan recipient. For anyone looking for better rate, the potential for big discounts has never been better as competition between lenders for borrowers is intense, particularly for those looking to refinance. It’s important to remember that while commercial interest rates tend to move in line with the cash rate, lenders are under no obligation to pass on an RBA cut to their customers in full, or at all. While you’ll be paying more each month than you would with an interest only loan, the good news is that by the end of your loan term, you’ll own your home entirely.

The first-home grant owner is a famous model for motivating home ownership as where government contributes to a person's savings intended for purchasing a home. The government provides a percentage of yearly savings to lessen the length of the saving period. The strategy is effective in promoting savings among potential home owners seeking homes with values below $400,000.

This would mean you’ll pay more each month, so be sure to check your budget before going ahead, but it will save you money overall. So, say you had a loan of $150,000, at an interest rate of 3.98%. On a 25 year term, you’d pay $790 each month and a total of $87,030 in fees and interest. If you reduced that to a 20 year term, your monthly payments would increase to $907, but all up, you’d only pay $67,774. The quicker you can get rid of your loan, the less interest you will pay. But be careful, as sometimes, particularly with fixed term interest rates, you may be charged extra fees or penalties for paying off your loan before the complete term is finished.

However, this will change as you chip away at your principal over time. To work out how much you would pay over the life of a loan, use our home loan repayments calculator. Ensure that there is a high likelihood that you’ll qualify for a home loan before you apply. The way the credit system works, each application for credit is recorded against your name. Multiple entries in a short space will more than likely lead to rejection. Other factors that lenders may consider to assess your eligibility are your income, assets, liabilities, employment and credit history.

No comments:

Post a Comment